The Report Settings section allows you to adjust the default report frequencies as these will vary by customer depending on company size.

1. Navigate to Reports > Report Settings.

2. Locate the report that you wish to edit by either scrolling down the list by using the Jurisdiction filter on the left of the window

3. Click on the name of the report you wish to edit.

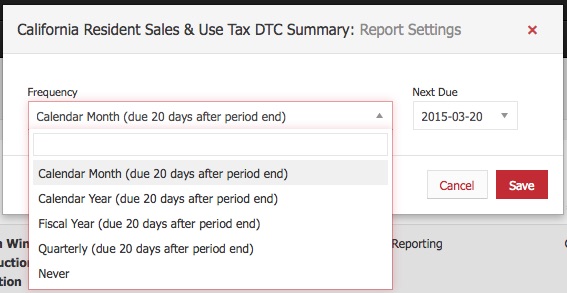

4. Select how often you are required to file your report the Frequency dropdown.

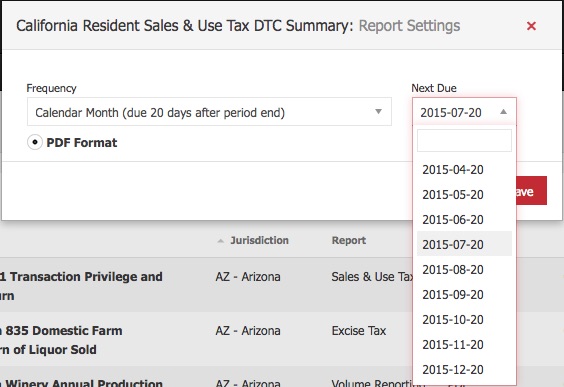

5. Select a date from the Next Due dropdown.

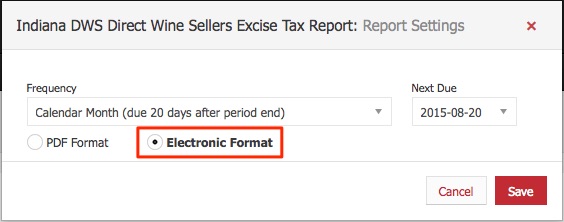

6. Most reports only run the in standard PDF "paper" version of the report, however some reports allow for an electoric version alternative. If the report has an electronic version available you can choose to use it over the PDF version by clicking the Electronic Format option.

7. Click Save.

| Calendar Year |

Filed once a standard calendar year.

|

|---|---|

| Semi-annually |

Filed twice a standard calendar year.

|

| Quarterly |

Filed 4 times a standard calendar year.

|

| NY Sales Excise Tax Quarter |

Filed 4 times a year. New York does not use a standard calendar year but runs annually from March the previous year to May of the current year.

|

| NY Year |

Filed once every New York year. New York does not use a standard calendar year but runs annually from March the previous year to May of the current year.

|

| Bi-Monthly |

Filed every 2 months in a standard calendar year.

|

| Calendar Month |

Filed each standard calendar month. |

| Fiscal Year |

Filed filed once every fiscal year. Fiscal years are different from a standard calendar year and run from June of the previous year to May of the current year.

|

| Never |

You are not filing this report. |